Sales Ramp-Up Time in 2026: The Complete Guide with Benchmarks

- Sophie Ricci

- Views : 28,543

Table of Contents

Sales Ramp-Up Time in 2025

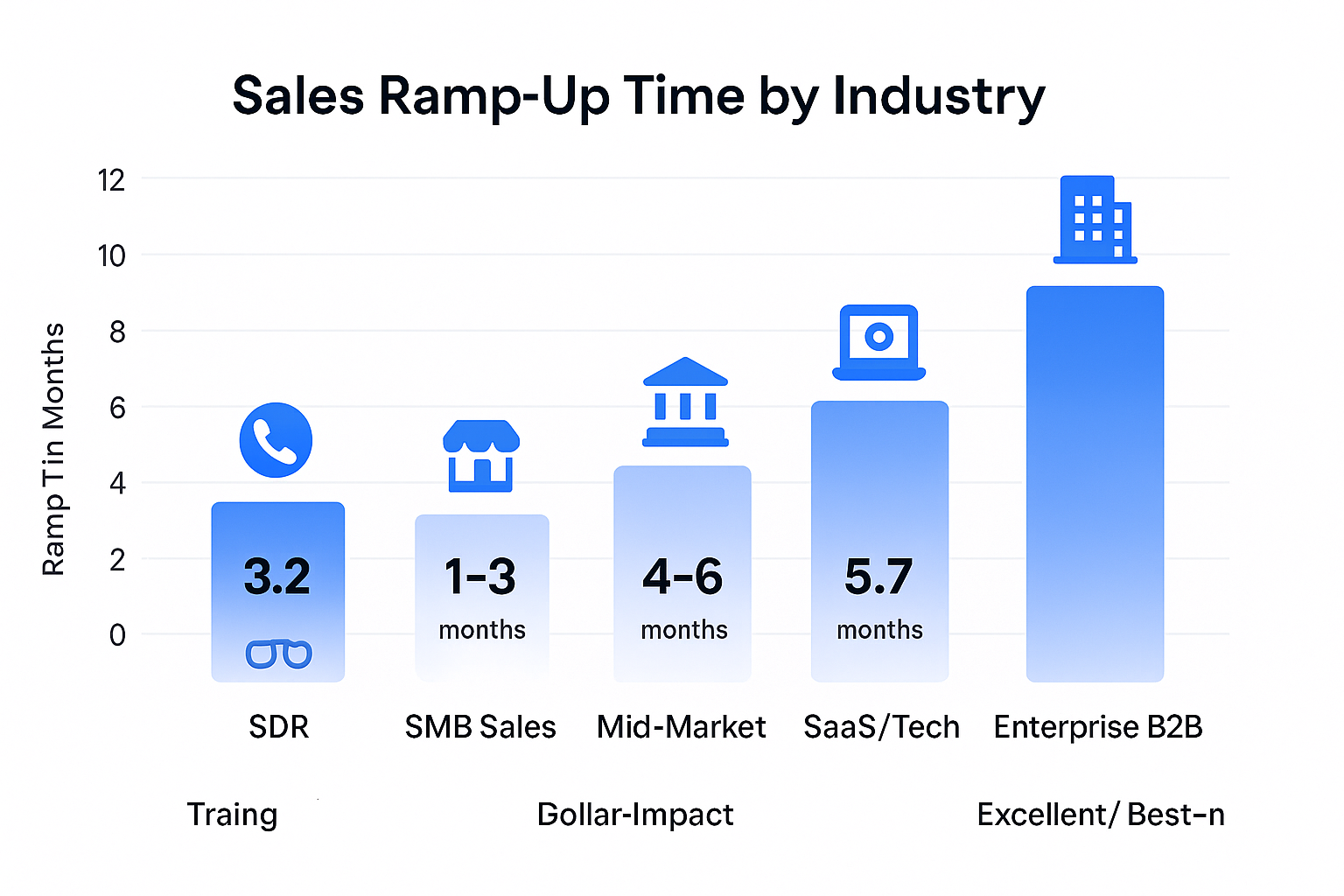

Average ramp-up time for SaaS companies has ballooned to 5.7 months in 2025, nearly half a year before ROI

Ramp-up time increased 32% from 4.3 months in 2020 to 5.7 months in 2025, showing significant slowdown

Enterprise B2B sales require 9-12 months to ramp due to long cycles and complex negotiations

Mid-market sales typically see 4-6 months ramp time, balancing velocity and consultative selling

SMB sales achieve the fastest ramp times between 1-3 months due to shorter cycles and simpler products

Sales Development Reps average 3.2 months ramp time, faster than full-cycle account executives

Research shows it takes over 7,000 activities to close the first deal for new sales hires

20% of new sales hires leave within the first 90 days, primarily due to poor onboarding

Total cost to ramp a new sales rep is estimated at three times their base salary including recruiting and training

69% of employees are more likely to stay for at least three years if they experience great onboarding

88% of companies admit their onboarding is subpar, often lasting just a week or less

Organizations with formal onboarding boost retention by 82% and productivity by over 70%

Companies with aligned sales and marketing report 19% faster growth and 15% higher profits than misaligned teams

Sales teams using AI tools see productivity gains of up to 30%, accelerating ramp significantly

Sellers who actively use AI are 3.7 times more likely to meet quota compared to those who don’t

Here’s something most sales leaders won’t tell you: the time it takes for your new sales hire to actually start bringing in revenue is getting longer. And it’s costing you way more than you think.

We’re talking about ramp-up time—the period between when someone joins your team and when they’re consistently hitting quota. In 2025, this number has ballooned to an average of 5.7 months for SaaS companies. That’s nearly half a year of salary, benefits, and lost opportunities before you see a return.

But here’s the thing: it doesn’t have to be this way.

In this guide, we’re breaking down everything you need to know about sales ramp-up time—what it really is, how yours compares to industry standards, and most importantly, how to slash it so your team starts producing revenue faster.

Let’s dive in.

What Is Sales Ramp-Up Time?

Think of ramp-up time as the runway your new hire needs before takeoff.

It’s the period from day one until they’re consistently achieving their sales quota. During this time, they’re learning your product inside and out, understanding your sales process, figuring out your ideal customer, and building enough pipeline to close deals predictably.

But ramp-up time isn’t just about training. It’s about real performance.

A new hire might complete all your onboarding modules in week one, but that doesn’t mean they’re ramped. They’re only truly ramped when they can independently manage their territory, navigate complex deals, and hit their numbers month after month.

Why does this matter? Because every day someone spends ramping is a day they’re not generating revenue. And in sales, time equals money.

Here’s the reality: Research shows it takes over 7,000 activities to close the first deal. That’s prospecting calls, emails, demos, follow-ups—all while learning on the fly. The longer this takes, the more it costs your business in lost revenue and wasted resources.

2025 Industry Benchmarks: How Does Your Team Compare?

Let’s get specific. What’s actually “normal” for ramp-up time?

The answer depends heavily on your sales model and deal complexity. Using a one-size-fits-all benchmark is misleading—a nine-month ramp might be reasonable for enterprise software but would signal a massive problem for a high-velocity SMB sales team.

Here’s what the data shows for 2025:

For SaaS and Technology Sales: The average ramp-up time is now 5.7 months. This is up from 5.3 months in 2022 and just 4.3 months in 2020—a 32% increase in just four years. If your ramp time falls in the 4-6 month range, you’re in the ballpark.

For Enterprise B2B Sales: Expect 9-12 months. These deals involve long sales cycles, multiple stakeholders, and complex negotiations. The extended ramp time reflects the sophistication required to navigate these environments.

For Mid-Market Sales: Most teams see 4-6 months. This strikes a balance between transactional velocity and consultative selling.

For SMB Sales: The fastest ramp times fall between 1-3 months. Shorter sales cycles and more straightforward products allow new hires to get productive quickly.

For Sales Development Reps: Average ramp time is 3.2 months. Since SDRs focus on activity metrics and booking meetings rather than closing revenue, they typically ramp faster than full-cycle account executives.

The bottom line? If you’re in SaaS and your ramp time is pushing 7+ months, you’ve got a problem. If you’re in SMB and it’s taking 5+ months, something’s broken.

🎯 Eliminate the Pipeline Problem Today

Our LinkedIn outbound system fills new rep pipelines with qualified leads in week one.

How to Actually Calculate Ramp-Up Time

You can’t improve what you don’t measure. Here are three proven methods to calculate your team’s ramp-up time.

Time to Full Quota Attainment

This is the gold standard. Track the average time it takes new hires to achieve 100% of their assigned quota.

Formula: $$\text{Ramp-Up Time} = \text{Average months for new hires to reach 100% quota}$$

Example: You hire three people. One hits quota in month 5, another in month 6, and the third in month 7. Your average ramp-up time is 6 months.

Best for: Established teams with historical data.

Sales Cycle Multiplier

If you don’t have historical quota data, use this forward-looking approach. Take your average sales cycle length and add a buffer (typically 90 days).

Formula: $$\text{Ramp-Up Time} = \text{Average Sales Cycle Length} + 90 \text{ days}$$

Example: Your average sales cycle is 38 days. Add 90 days for training and acclimation. Your estimated ramp-up time is 128 days, or about 4.3 months.

Best for: Early-stage companies or new teams.

Revenue Productivity Ratio

This method focuses on efficiency. Calculate how long it takes a new hire to generate revenue that justifies their cost. Full productivity is typically defined as reaching 80% of their revenue target.

Formula: $$\text{Ramp-Up Time} = \frac{\text{Monthly Revenue Target}}{\text{Average Monthly Sales During Ramp}}$$

Example: A new hire has an $80,000 monthly target. In their first few months, they average $20,000/month. Ramp-up time is 4 months.

Best for: Companies laser-focused on ROI and financial efficiency.

Pro tip: If your sales cycle buffer method predicts 4 months but your actual time-to-quota data shows 7 months, that gap is a red flag. Your onboarding process isn’t living up to expectations.

Why Ramp-Up Time Matters More Than Ever

Fast ramp time isn’t just a nice-to-have. It’s a competitive weapon.

Revenue Growth

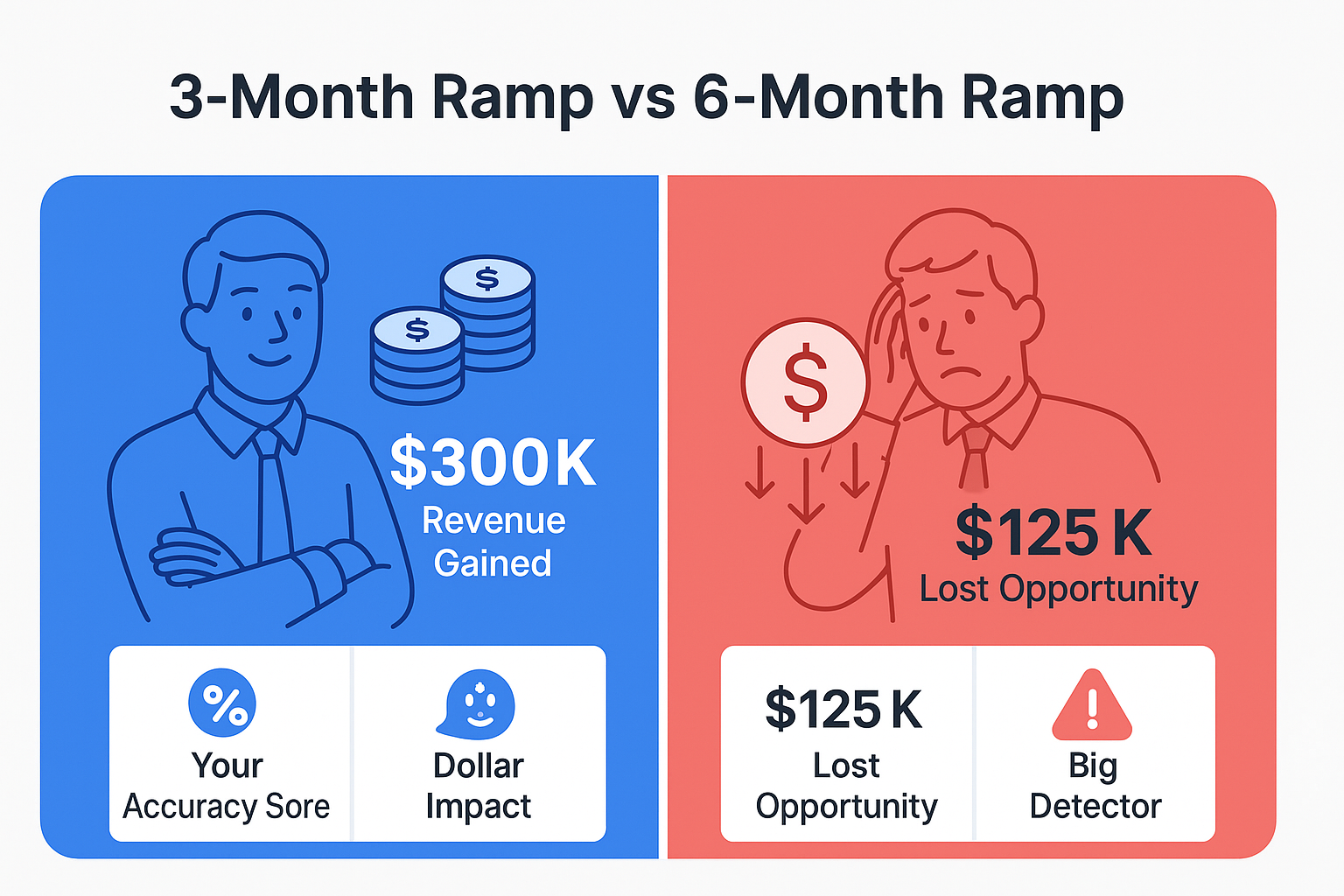

Every month a new hire spends ramping is a month without revenue. If someone with an annual quota of $500,000 takes six months to ramp instead of three, you’re losing over $125,000 per person. Scale that across five new hires and you’re looking at $625,000 in lost opportunity.

the first 90 days. And the primary reason? Poor onboarding.

When new hires feel overwhelmed, unsupported, or set up to fail, they leave. Fast. And when they leave, you’re stuck paying recruitment costs all over again. The total cost to ramp a new sales rep is estimated at three times their base salary when you factor in recruiting, training, and lost productivity.

On the flip side, 69% of employees are more likely to stay for at least three years if they experience great onboarding.

Budget Efficiency

Slow ramps create a revenue debt that drags down your entire organization. Struggling new hires put pressure on top performers to cover the shortfall, leading to burnout. Sales managers get pulled away from coaching to firefight or start yet another hiring process. It’s a vicious cycle.

The fastest way to break this cycle? Accelerate your ramp time.

Why New Hires Struggle to Ramp Quickly

If ramp times are climbing across the industry, something’s broken. Let’s talk about the real culprits.

Information Overload Without Structure

Most companies dump product docs, sales decks, and process guides on new hires in week one. 88% of companies admit their onboarding is subpar, often lasting just a week or less. This firehose approach leads to confusion, not clarity.

New reps don’t know what’s important, what to prioritize, or how to apply what they’ve learned. Result? Slower ramp times.

The Skills Gap for Internal Promotions

Promoting a top SDR to an account executive role seems logical. But the skills that make someone great at booking meetings don’t automatically translate to closing deals.

AEs need to manage full-cycle pipelines, navigate complex buying committees, handle sophisticated objections, and negotiate contracts. Many newly promoted AEs also make a critical mistake: they stop prospecting, wrongly assuming leads will just flow in.

Unrealistic Quotas and Bad Comp Plans

Expecting a new hire to carry full quota from day one is a recipe for disaster. Failure to implement tiered quotas is a primary cause of missed targets and early frustration. If your comp plan doesn’t account for ramp time, you’re demotivating your new hire before they’ve had a fair shot.

Poor Quality Leads

Here’s the truth nobody wants to say out loud: you can’t build momentum without a pipeline.

When new hires spend their first 90 days sifting through bad data, chasing unqualified prospects, or dealing with empty lead flow, their ramp time balloons. They need wins early to build confidence and learn what good looks like. No pipeline means no practice, no wins, and no progress.

Companies with tightly aligned sales and marketing teams report 19% faster growth and 15% higher profits. A consistently slow ramp-up time is often a symptom of a broken go-to-market engine, not just a training problem.

🚀 Fix Your Lead Quality Problem

We build targeted LinkedIn campaigns that give new hires the qualified pipeline they need.

Lack of Ongoing Coaching

Onboarding isn’t a one-week event. It’s a continuous process.

72% of new hires say one-on-one time with their manager is the most important part of onboarding, yet most sales managers lack the time or training to deliver effective coaching. Without regular feedback, new reps navigate complex challenges alone, slowing their development and increasing failure risk.

5 Proven Strategies to Slash Ramp-Up Time

Enough with the problems. Let’s talk solutions.

Build a Structured 30-60-90 Day Onboarding Program

Ad-hoc onboarding kills ramp speed. The data is clear: organizations with formal onboarding boost retention by 82% and productivity by over 70%.

Here’s how to structure it:

Days 1-30 (Foundation Phase): Focus on knowledge. Product training, company culture, CRM basics, buyer personas, and shadowing top performers.

Days 31-60 (Application Phase): Shift to doing. New hires should conduct their own discovery calls and demos, start building pipeline, and aim to close their first deal by day 45-60.

Days 61-90 (Autonomy Phase): Full ownership. They should manage their territory independently, consistently hit 80%+ of target activity metrics, and demonstrate they can handle the full sales cycle.

The key is comprehension, not memorization. Use role-playing exercises, scenario-based training with real deal data, and active shadowing. You want problem-solvers, not script-readers.

Fuel Early Wins with High-Quality Leads

Nothing accelerates ramp-up faster than early confidence from closing deals.

Giving a new hire 1,000 unvetted contacts is setting them up to fail. Give them 100 well-qualified leads that match your Ideal Customer Profile, and you’re setting them up to win.

Here’s where modern prospecting tools become essential. Platforms like Salesso eliminate the grunt work of prospecting by providing instant access to verified B2B contacts. Instead of spending weeks building lists, new hires can focus on what matters: having conversations and closing deals.

Automation also helps. It takes over 7,000 activities to close the first deal. Tools that automate outreach sequences ensure consistent communication and prevent leads from slipping through the cracks, building pipeline faster.

Bottom line: prioritize lead quality over quantity. Your new hire’s success depends on it.

💼 LinkedIn Outbound Accelerates Ramp-Up

Complete targeting, campaign design, and scaling that puts meetings on calendars from day one.

Implement Continuous Coaching, Not One-Time Training

Coaching has a direct impact on performance. Organizations with regular sales coaching see a 28% improvement in quota attainment. When you combine AI with coaching, that number jumps even higher—teams using AI-powered coaching tools see 3.3x year-over-year growth in quota attainment.

What does good coaching look like?

Manager-led coaching: Regular one-on-ones, pipeline reviews, and call coaching sessions. 90% of sales reps who receive manager coaching rate it positively.

Peer learning: Create a cohort of new hires so they learn together. Implement “Win of the Week” showcases. Assign onboarding buddies—new hires who meet regularly with a buddy are up to 97% more productive.

The key is consistency. Coaching can’t be a once-a-month event. It needs to be woven into the fabric of your team culture.

Leverage AI for Real-Time Guidance

AI isn’t hype anymore. It’s a practical tool that accelerates performance.

Sales teams using AI tools see productivity gains of up to 30%, and sellers who actively use AI are 3.7 times more likely to meet quota.

Here’s how to use it:

AI-powered onboarding platforms: Create personalized learning paths that adapt based on a rep’s progress, role, and skill gaps.

Real-time call coaching: AI conversation intelligence tools analyze live calls and surface real-time suggestions—relevant talking points, objection responses, data to support claims. Deals supported by AI coaching assistants close an average of 11 days faster.

AI for prospecting: Identify high-intent leads, automate CRM data entry, and build streamlined outreach sequences. This saves reps up to 5 hours per week that can be reinvested into selling.

⚡ Stop Waiting for Reps to Ramp

Our proven LinkedIn outbound framework delivers consistent pipeline while your team learns to close.

7-day Free Trial |No Credit Card Needed.

Set Realistic Expectations with Tiered Quotas

Expecting full quota from day one is unrealistic and demotivating.

Implement a transparent ramped quota structure. Here’s a proven model:

- Months 1-2: 0% of quota (focus is training and learning)

- Month 3: 50% of full quota

- Month 4: 75% of full quota

- Month 5: 100% of full quota

Consider offering a commission guarantee or draw for the first three months to relieve financial pressure. This demonstrates your investment in their success and lets them focus on learning the right behaviors instead of worrying about their paycheck.

Conclusion: Turn Ramp-Up from Cost Center to Competitive Advantage

The average sales ramp-up time of 5.7 months isn’t just a number. It’s millions of dollars in lost revenue, high turnover costs, and depressed team morale.

But here’s the opportunity: most companies are doing onboarding wrong. That means the bar is low. By implementing a structured onboarding program, providing high-quality leads, fostering continuous coaching, leveraging AI tools, and setting realistic expectations, you can turn your ramp-up process from a cost center into a competitive weapon.

The biggest differentiator? Your new hire’s pipeline.

They can’t learn, grow, or contribute if they’re spending their first 90 days searching for needles in a haystack. The fastest path to slashing ramp time is equipping them with quality leads from day one.

Ready to accelerate your sales team’s ramp-up time? Salesso gives you instant access to verified B2B contact data, helping your new hires build targeted prospect lists and start booking meetings in week one. No more wasted time on bad data. Just high-quality leads that fuel early wins. Try Salesso today.

Internal Links:

I’ll create the “Other Useful Resources” section for the Forecast Accuracy Statistics article with properly categorized internal links. Here’s the section to add before the “Forecast

Other Useful Resources

To understand how to eliminate the forecast accuracy crisis through predictable LinkedIn pipeline generation, explore these resources:

Email Deliverability & Infrastructure:

- Compare Folderly alternatives for email deliverability monitoring supporting outbound campaigns

- Explore inbox placement tools ensuring forecasted pipeline reaches decision-makers

Prospecting Strategy:

- Review comprehensive B2B prospecting methods understanding systematic approaches eliminating “Ghost Deals”

Pipeline & Meeting Management:

- Learn how to schedule appointments with clients streamlining conversion from forecast to close

Decision-Maker Strategy:

- Learn how to reach B2B decision-makers engaging verified prospects eliminating “Walking Dead Deals”

LinkedIn Profile Optimization:

- Review LinkedIn headline for student understanding profile fundamentals

Platform Intelligence:

- Review LinkedIn learning usage statistics showing platform professional development engagement

Forecast accuracy statistics document the systematic predictability crisis—93% of sales leaders can’t forecast revenue within 5% margin even with just 2 weeks remaining in quarter, only 20% achieve “excellent” 5% benchmark while 43% miss by 10%+ and 80% fail to achieve >75% accuracy, less than 50% have high confidence in forecasting with fewer than 20% rating forecasts as “predictable,” yet 67% lack structured formalized forecasting approach creating vicious cycle where widespread failure erodes leadership trust driving dysfunctional sandbagging (under-forecasting for guaranteed wins) and happy ears inflation (optimistic over-forecasting) both becoming primary contributors to forecast errors feeding the documented performance crisis. The career impact proves brutal: over-forecasting kills credibility inviting micromanagement and autonomy loss, under-forecasting starves organizations of resources manifesting as smaller marketing budgets generating fewer quality leads and hiring freezes leaving reps buried in administrative tasks, yet mastering accuracy delivers tangible advantages where 97% of companies with industry-leading forecasting processes reach sales quota versus only 55% without, teams mastering forecasting are 10% more likely to grow annual revenue and 2x likely to outcompete peers demonstrating forecast accuracy as internal currency buying autonomy, trust, and preferential resource access versus low accuracy incurring “tax” of micromanagement and friction. The Five Forecast Killers systematically undermine accuracy: (1) Seller Subjectivity relying on gut feelings and happy ears optimism rather than objective buyer actions, (2) Haunted Pipeline cluttered with Ghost Deals (no amounts), Timeless Wonders (no close dates), Walking Dead Deals (30+ days inactive = 80% less likely to close) padding false security, (3) Undefined Deal Stages advancing on subjective “feels like” rather than objective buyer-centric milestones, (4) Market Myopia ignoring economic/competitive/regulatory headwinds, and (5) Buyer Indecision (markers in 90% of sales calls) misinterpreted as continued progress creating causal chain from lack of objective process forcing seller subjectivity directly resulting in haunted pipeline filled with poorly qualified deals lacking concrete amounts/dates/commitment struck by external shocks collapsing forecasts built on emotional investment misinterpreting red flags as minor delays. The improvement infrastructure exists—establishing baseline through 4-quarter self-audit calculating personal MAPE/bias, conducting ruthless weekly pipeline reviews with complete critical fields/next steps/30-day activity checks/objective stage verification, becoming sales cycle expert flagging deals exceeding average length, reframing 1:1s from reporting to strategic coaching about deal health, committing with strict “Commit/Best Case/Pipeline” discipline, and leveraging AI reducing errors 20-50% through bias elimination and risk detection preventing “happy ears” and “Walking Dead” invisibility—yet systematic execution preventing the forecast killers and implementing disciplined process requires infrastructure most organizations operating on 67% lacking structured approaches and <20% predictability ratings cannot maintain consistently. But here’s what forecast accuracy statistics alone don’t solve: knowing 93% can’t forecast within 5% doesn’t achieve it from current state, understanding 97% with industry-leading processes reach quota versus 55% without doesn’t implement those processes, recognizing Five Forecast Killers doesn’t eliminate them, appreciating AI reduces errors 20-50% doesn’t deploy it strategically, and documenting need for objective deal stages, clean pipeline, weekly reviews, strict commit discipline doesn’t execute systematically preventing the 10% revenue growth and 2x competitive advantage documented for forecasting masters. The root cause emerges clearly: forecast accuracy crisis stems from pipeline quality unpredictability where Ghost Deals, Timeless Wonders, and Walking Dead opportunities bloat forecasts creating false security based on seller subjectivity and happy ears optimism rather than objective buyer actions across verified high-intent prospects with real budgets, concrete timelines, and defined next steps enabling predictable progression through objective stage criteria most organizations filling pipelines with unqualified leads, cold prospects showing no intent, and recycled opportunities padding CRM cannot achieve making accurate forecasting mathematically impossible regardless of process discipline. The article’s repeated banner positioning addresses this fundamental root cause: “Struggling With Pipeline Predictability?” filling pipeline with qualified leads for accurate forecasts, “Fix Your Pipeline at the Source” through predictable LinkedIn campaigns delivering consistent quality leads every quarter, “Want 97% Quota Attainment?” starting with predictable lead flow from proven LinkedIn targeting, “Stop Chasing Ghost Deals” through pre-qualified prospects with real budget and intent, and “AI Meets LinkedIn Outbound” combining data-driven targeting with scalable campaign design for predictable revenue growth. Our complete LinkedIn outbound system eliminates the forecast accuracy crisis at its root—delivering 15-25% response rates through done-for-you targeting, campaign design, and scaling that fills pipeline with pre-qualified prospects having verified budget, authority, need, and timeline eliminating Ghost Deals (every opportunity has realistic amounts), Timeless Wonders (concrete close dates from qualified buying intent), and Walking Dead opportunities (consistent activity preventing 30+ day staleness reducing 80% close likelihood), providing objective buyer actions not seller subjectivity (LinkedIn engagement, response patterns, stakeholder involvement showing actual intent), enabling predictable quarterly lead flow eliminating pipeline unpredictability preventing accurate forecasting, and combining AI-powered targeting with systematic campaign execution achieving the industry-leading forecasting processes delivering 97% quota attainment (versus 55% without), 10% revenue growth advantage, and 2x competitive superiority without the seller subjectivity, haunted pipeline, undefined stages, or buyer indecision misinterpretation preventing most organizations operating on 67% lacking structured approaches from converting forecast accuracy knowledge into actual predictable performance where <20% rate forecasts as “predictable” despite 93% unable to forecast within 5% margin even 2 weeks from quarter end revealing systematic pipeline quality crisis as root cause no amount of process discipline, AI deployment, weekly reviews, or strict commit categorization can overcome without first fixing the fundamental lead quality, qualification rigor, and prospect intent verification LinkedIn outbound directly addresses through systematic pre-qualified decision-maker targeting delivering the predictable pipeline foundation accurate forecasting requires eliminating the Ghost Deal, Timeless Wonder, and Walking Dead opportunities bloating CRM creating false security preventing 90-95% best-in-class accuracy most teams relying on unpredictable lead sources generating unqualified prospects with unclear budgets, timelines, and intent cannot achieve systematically.

- blog

- Statistics

- Sales Ramp-Up Statistics 2025: Benchmarks & Best Practices